salt tax deduction california

The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California. California Enacts SALT Workaround.

What Do They Mean By The Salt Tax Deduction Personal Finance Buffalonews Com

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

. High income tax rate. State and local taxes. I hired them again and they did a great job with that too.

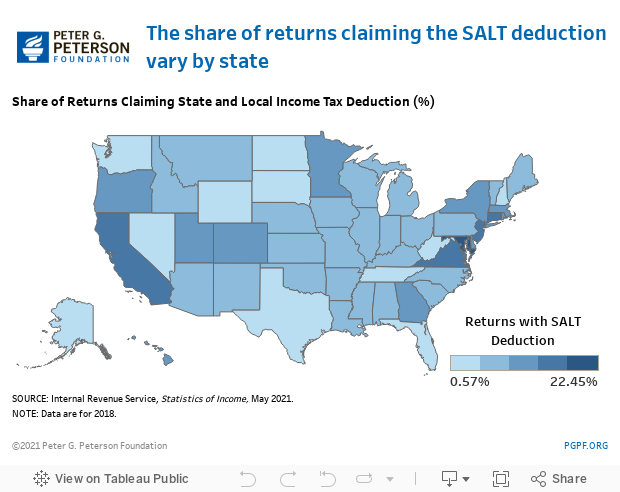

California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes. Californias average SALT bill is the third-highest in the US. The SALT deduction allows taxpayers to deduct state and local taxes from their federal taxable income and was written into the federal tax code since the inception of the.

As the first Tax Day without unlimited state and local tax deduction approaches an estimated 1 million California families will pay 12 billion more to Uncle Sam. This is due to the states. Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. In July of 2021 Governor Newsom signed California Assembly Bill 150 into law which. Rosenthal JD and Krista Schipp CPA.

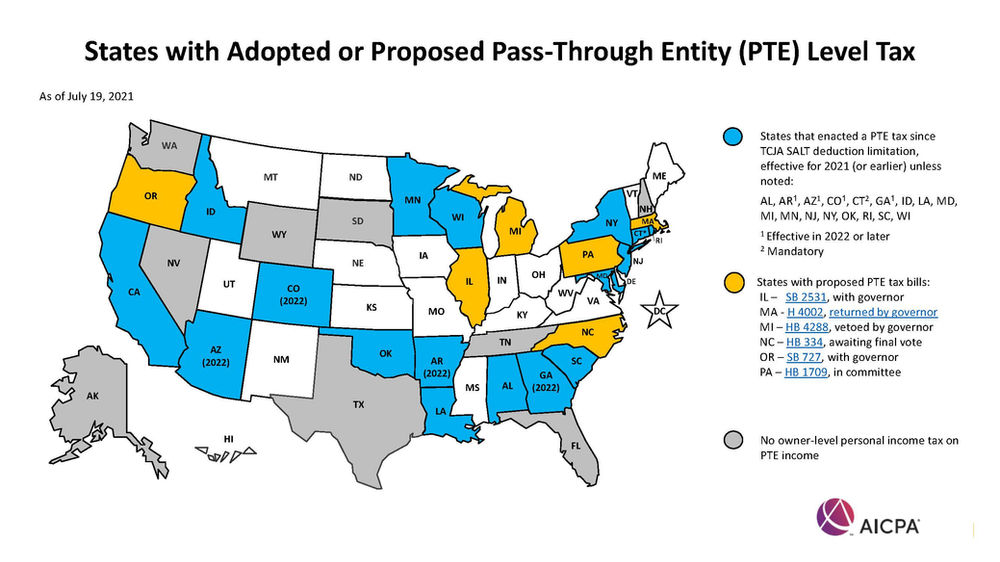

Since the passing of the TCJA you can only deduct 10000 effectively losing a deduction 12000. On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

The federal tax reform law passed on Dec. The California SALT deduction workaround passed July 16th 2021 with the California Budget and will be effective from 2021 to 2025. California does not allow.

Then in December 2017 The Tax Cuts and. For your 2021 taxes which youll file in 2022 you can only itemize when your. 1 The cap on SALT deductions applies for tax.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted. The TCJA added in IRC Section 164b6 effectively placing a 10000 cap on taxpayers federal itemized SALT deductions.

By Corey L. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. Adding the 10000 cap increases the payment of an average.

Ad They did an excellent job. Learn More At AARP. While AB-150s elective tax work-around appears quite favorable to California residents the devil is always in the details which we address below.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. But you must itemize in order to deduct state and local taxes on your federal income tax return. California Governor Gavin Newsom signed into law budget legislation that includes a workaround of the 10000 federal cap on state and local tax SALT deductions.

California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the. Second the 2017 law capped the SALT deduction at 10000 5000 if. Youll know how much your project costs even before booking a pro.

California Governor Gavin Newsom signed Assembly Bill 150 on July 16 2021 incorporating a state and local tax SALT workaround through an elective 93 tax for pass. How long is the SALT deduction in effect. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

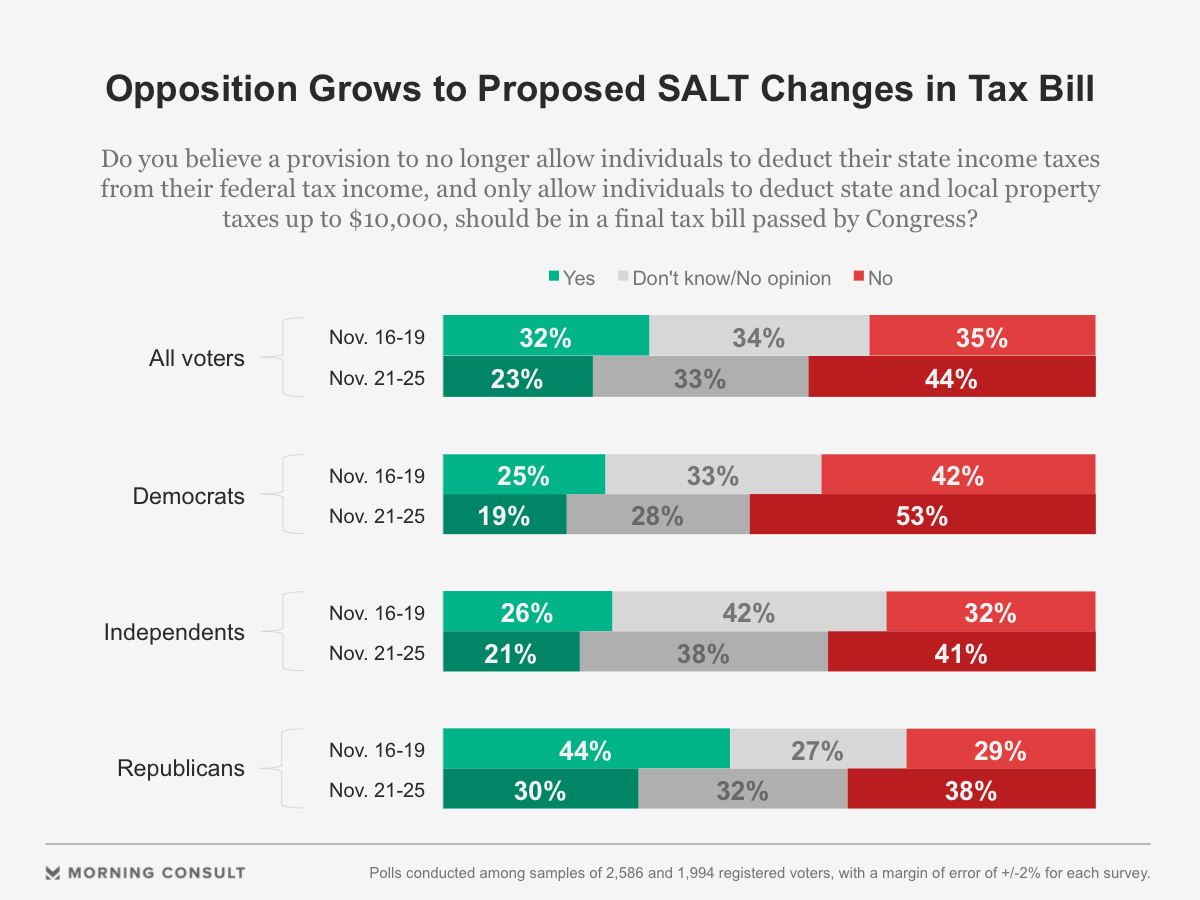

Voters Increasingly Oppose Proposed Salt Deduction Changes

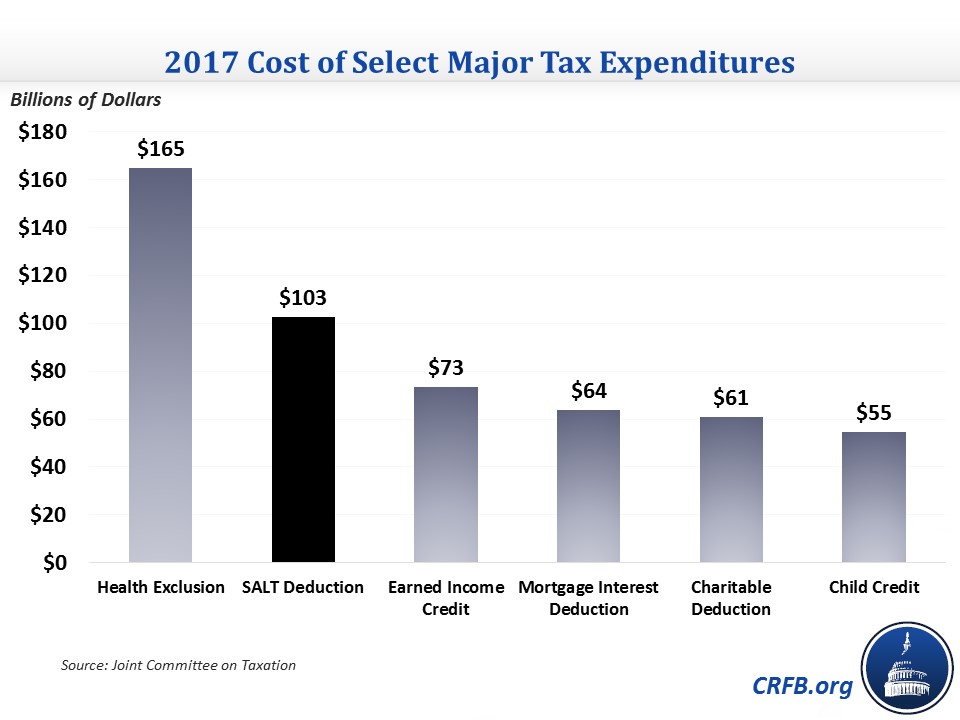

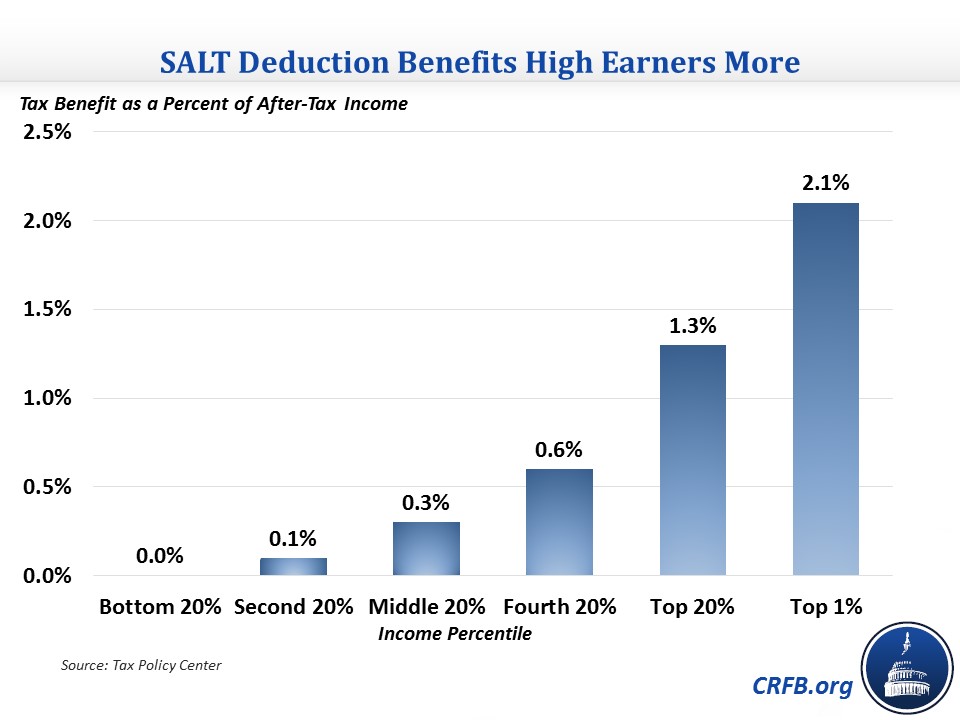

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

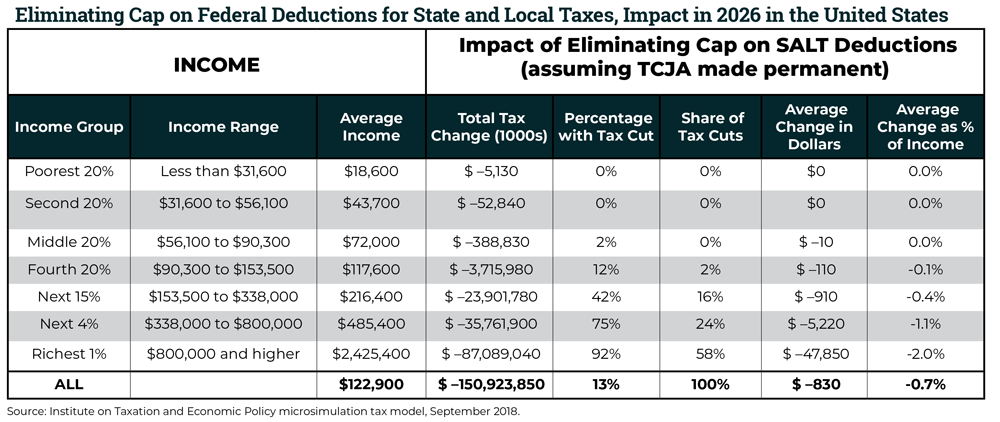

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

California Democrats Have Chance To Restore Salt Deductions Los Angeles Times

How Does The Deduction For State And Local Taxes Work Tax Policy Center

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

What Is The Salt Tax Deduction Forbes Advisor

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How To Get A State Tax Deduction Post Tcja The Passthrough Entity Level State Tax

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How Does The Deduction For State And Local Taxes Work Tax Policy Center